VA Loan Guide: What It Is and How It Works

Buying a home is hard work. And if you’re a veteran or serving in the military it can be more of a challenge compared to folks who aren’t.

That’s why the U.S. Department of Veterans Affairs (VA) created the VA loan as a mortgage option specifically for veterans.

Before we unpack what it is exactly, let’s cover the top reasons why some veterans like VA loans:

Zero down payment required

No PMI fees

You can use the loan multiple times

Sure, those points make the VA mortgage loan sound nice. But it’s not all sunshine and rainbows when you take a closer look at what the VA loan really is and how it all works.

What Is a VA Loan?

A VA loan is a home mortgage backed by the U.S. Department of Veterans Affairs—but you can get one by shopping with any type of lender, like a bank or mortgage company. It was designed to help U.S. veterans, active-duty service members, and widowed military spouses buy a house.

The VA mortgage was introduced as part of the GI Bill in 1944. They’re not the most popular type of mortgage by any means—making up only 5–6% of all mortgages at the start of 2021.1 People who opt for VA loans usually do it because they can’t qualify for a more traditional conventional loan.

How Does a VA Loan Work?

The VA home loan is considered an unconventional (or government) loan. They’re different than conventional loans because VA loans are specifically guaranteed by the government.

This just means the government agrees to repay a portion of the loan to the lender who gave you your VA loan if you don’t make your mortgage payments (default) and they have to repossess your house (foreclosure).

Since your lender takes on less risk compared to a conventional loan, VA mortgage loans are relatively easy to get.

Who Qualifies for a VA Loan?

In order to get this loan when you're looking to buy a home, military personnel have to meet the VA’s specific service requirements.

Generally, you’re eligible if you fall into one of these three categories:

You’re an active-duty service member or an honorably discharged veteran who has 90 consecutive days of active service during wartime or 181 days of active service during peacetime.

You have served more than six years in the National Guard or the Selected Reserve.

You’re the spouse of a service member who died in the line of duty.

How to Apply for a VA Loan

To apply for a VA loan, you need a Certificate of Eligibility (COE) to show mortgage lenders that you qualify.3 You can apply for a COE through the VA website, by mail, or through your lender.

For a snapshot view of what this process looks like, here are six steps on how to get a VA loan:

Get a COE from the VA

Get preapproved by a lender

Go house hunting

Make an offer

Wait for lender to process your loan

Close on your house

Notice how the steps are all pretty much the same as with any home-buying process. The main difference here is getting that Certificate of Eligibility.

Can You Use a VA Loan Multiple Times?

Yes, a VA home loan is a lifetime benefit for those who qualify. No matter how many times you sell your house and buy a new one, you can still get another VA loan.

What Are the Benefits of a VA Loan?

Here are some of the key features and benefits of a VA mortgage:

You can buy a home with no down payment. VA mortgages are one of the last zero-down home loans available today. But we at Ramsey never recommend getting a mortgage with a zero or low down payment (more on that later).

There is no limit to the amount you can borrow on a VA loan. But there is a limit to the amount the VA is willing to guarantee to your lender. As of 2021, the VA will back a loan up to $548,250, which means the VA would guarantee 25% ($137,062) of that if you defaulted.5 Anything beyond that won’t be backed by the VA. Sound dangerous? It can be!

You won’t have to pay private mortgage insurance (PMI). PMI is an insurance you pay for that protects your lender (not you) if you default on your loan. But since VA home loans are backed by the government, you can kiss PMI goodbye!

There’s no minimum credit score requirement. Keep in mind, while the VA won’t deny you a loan for having a low credit score, your lender still might. That’s because a low score usually means you’ve had trouble paying back money you’ve borrowed. But if you follow what we teach at Ramsey about living a debt-free lifestyle—you’ll have no credit score at all. If that’s you, it’s still possible to get a mortgage with no credit score.

The VA offers assistance for struggling borrowers facing a potential foreclosure. The agency’s loan technicians can negotiate with lenders on behalf of borrowers who are having trouble making mortgage payments.

There is no prepayment penalty. This means you won’t be fined if you pay off your loan early.

You don’t need to be a first-time home buyer in order to get a VA loan. As long as you pay it off each time, you can use the benefit again and again.

Bankruptcy and foreclosure won’t permanently affect your chances. If you’ve filed for bankruptcy or gone through a foreclosure, you can still qualify for a VA loan after two years have passed from the date of the bankruptcy or foreclosure.

What Are the Drawbacks of a VA Loan?

This all sounds great so far, right? But if you dig a little deeper, you’ll find some serious problems with this type of loan.

The zero down payment leaves you vulnerable. A small shift in the housing market might leave you owing more on your home than its market value! That means you could get stuck with the home until the market recovers or take a financial loss if you have to sell the house in a hurry.

You’re required to pay a VA loan funding fee between 1.4–3.6% of the loan amount as of 2020.7 On a $300,000 loan, that fee can be anywhere from $4,200–10,800. And the fee is usually included in the loan, so it increases your monthly payment and adds to the interest you pay over the life of the loan. Plus, you might need to factor in origination fees from the lender. Yikes!

The lower interest rates on VA loans are deceptive. While interest rates for 30-year VA loans are usually equal to or slightly lower than 30-year conventional loans, neither loan is a good option. Both will end up costing you much more in interest over the life of the loan than their 15-year counterparts.

A VA loan can only be used to buy or build a primary residence or to refinance an existing loan. So you can forget trying to buy an investment property or vacation home with one. (Besides, using a loan to buy an investment property or vacation home instead of 100% cash is always a bad idea because it means more debt.)

Only certain types of properties are eligible for a VA loan. You can’t buy vacant land with a VA loan unless part of the loan is used to build a home. And you can’t buy co-ops . . . for now. A bill was introduced into Congress that would allow VA loans to be used to purchase co-ops, but it’s been stalled for years (go figure).

Is a VA Loan Worth It?

A VA loan usually isn’t worth it in the long run. The main reason is because people mostly get them to skip saving for a down payment.

A low or no down payment makes your loan tens of thousands of dollars more expensive—and that can lead to all sorts of money problems down the road.

We don’t want that for you. That’s why at Lawler Capital we teach home buyers how to save a big down payment of 20% or more on a 15-year fixed-rate conventional loan—this is your overall lowest cost mortgage option.

VA Loan vs. Conventional Loan

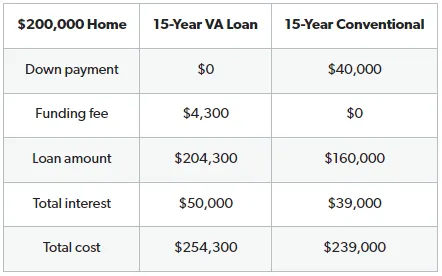

What if you decided to save up a 20% down payment on a $200,000 home and went with a 15-year fixed-rate conventional mortgage instead of a VA loan?

Let’s compare the numbers. We’ll use an interest rate of 3% for both a 15-year VA loan and a 15-year conventional loan.

Let’s say the VA loan comes with a funding fee that’s 2.3% of your $200,000 loan amount—that’d be $4,300. Since you don’t have the cash, you add it to your loan amount. Using our mortgage payoff calculator, you can add up the total cost of your interest for both loan types.

Notice how the 15-year fixed-rate conventional loan saves you more than $15,000 compared to the VA loan. Think of what you could do with all that money!

The bottom line is this: VA loans are usually one of the most expensive ways to buy a home. If you have to take out a loan in order to buy a home, go with a 15-year fixed-rate conventional mortgage with a 20% or more down payment to avoid paying PMI. Outside of buying your home with cash, it’s the best way to go.

Work With a Jesse Lawler - Trusted Mortgage Specialist

To make the smartest decision when shopping for a mortgage, contact our friends at Churchill Mortgage. For decades, their home loan specialists have coached hundreds of thousands of people on how to get a mortgage that actually helps them pay off their homes faster.