Frequently Asked Question 5

How much will my closing cost be and do I have to pay them?

Seller’s Credit – Because we are in a sellers’ market, seller credit is becoming harder and harder to come by, but it never hurts have your realtor request a specific amount of seller’s credit when writing up your offer! For example: Buyer requests $4,000 in closing cost credit.

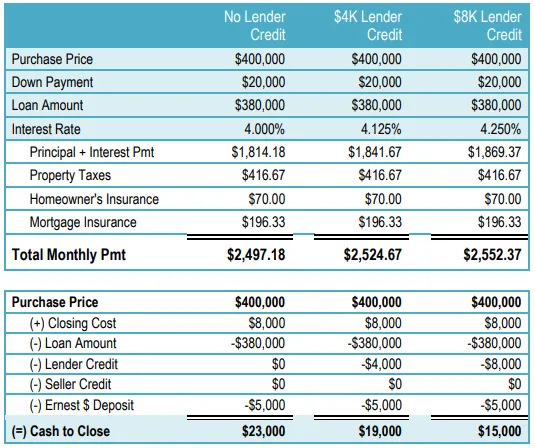

Lender Credit – This is the most commonly used option, because lender credit is almost always an available option (99% of the time) and the benefit to the borrower (you) far exceeds the short term and long term costs. Let me explain: Let’s say you are buying a home for $400K, putting 5% down, and the closing costs are $8,000. Unfortunately the seller is not giving you any seller credit. You now have 2 options, pay the closing cost along with your down payment ($28,000) or receive lender credit for all or a portion of your closing costs. Because lender credit is dependent on the interest rate you choose, the higher your interest rate=more lender credit for closing costs.

You can see from the table above that moving up in interest rate 1/8% (in this example), gives you $4K in lender credit and increases your monthly payment by $27.49 per month due to the higher interest rate. Another option is to move up 1/4% in rate, which gives you $8K in lender credit and increases your monthly payment by $55.19.

The choices are yours, but consider this: In the example above, it would take 145 months (over 12 years) of saving $55.19 per month to save $8,000. For this reason, most clients choose lender credit vs. paying closing cost out of pocket. It makes more financial sense to take the lender credit now vs. saving a small amount over a prolonged period of time. Whatever your choice is, you have options!

Out of Pocket – This is where you pay your closing costs in addition to your down payment. Rarely do clients choose this option, but it is an option.