What Is an FHA Loan?

For most people, buying a house also means getting a home loan. But if you’re a first-time home buyer or you’re struggling to save for a down payment, watch out! Don’t let an FHA loan take advantage of you.

Ready to see what an FHA loan is, how it works, and why we suggest steering clear?

Let’s get to it!

What Is an FHA Loan?

The Federal Housing Administration (FHA) gives loans to first-time home buyers and folks who might have a hard time getting approved for a conventional mortgage. Its goal is to get you into a home for as little money up front as possible.

Plus, you can qualify for an FHA loan with a low credit score or low down payment, and the closing costs are usually cheaper than a conventional mortgage. Sounds great, right?

The problem is, FHA loans actually cost tens of thousands of dollars more than a conventional loan in the long run. That’s why we don’t recommend them. Instead, we recommend paying 100% cash for a house (oh yeah, it's possible). If you do take out a home loan, we recommend a 15-year fixed-rate conventional mortgage from a smart lender who encourages you to pay off your house fast.

Let’s explore how FHA loans work and how they’re different from conventional loans so you can see for yourself.

How Do FHA Loans Work?

Remember: Lenders make money by charging you interest. If you default (aka fail to pay your mortgage), they lose money. First-time home buyers, people who make small down payments, or people with bad credit scores are the most likely to default. So the lender feels like giving you a conventional loan is too risky. But they still want to make money off you . . . so they came up with the FHA loan.

The FHA guarantees the loan—meaning if you default, your lender will foreclose on your house. Then the FHA pays the remaining balance of your loan, and the lender gives the FHA the house. (So the lender gets paid regardless—making it low-risk for them.)

Where does the FHA get the money to pay for the house? Since it’s a government agency, it must come from tax dollars, right? Nope. When you get an FHA loan, you have to pay mortgage insurance premiums (MIPs). We’ll explain those more in a minute, but basically, the FHA collects MIPs from everyone who has an FHA loan. Then if one borrower defaults, the FHA takes money from that pool to pay off the balance of that person’s loan.

FHA Loan Requirements

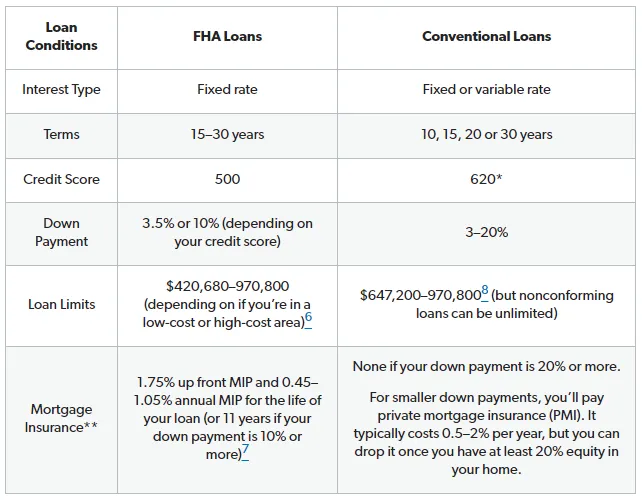

Since FHA loans are typically for buyers who have a hard time getting approved for a conventional loan, FHA loan requirements aren’t as strict as a conventional loan. Take a look:

Approved Lenders

Not all mortgage lenders like dealing with the red tape of government-backed loans, so you can only get an FHA loan from an FHA-approved bank, credit union or mortgage company.

Credit Scores and Down Payments

FHA loans are supposed to “help” people with low credit scores, but they still punish you by forcing you to make a bigger down payment if you have a lower score. Here’s how that works:

⚪Credit score of 580 or higher = 3.5% down payment

⚪Credit score of 500–579 = at least a 10% down payment

Imagine you buy a $200,000 house with an FHA loan, and you put down 3.5%. That’s $7,000. Then you’d borrow the other $193,000. (A 10% down payment on the same house would be $20,000.)

Income and Employment

You don’t have to make a certain amount of money to get an FHA mortgage. You just have to prove you have employment with steady income, and the longer you’ve had that income, the better.

Lenders also look at your debt-to-income ratio. They’ll check how much of your income you spend on monthly debt payments—like credit cards, student loans, car notes and medical bills—to make sure you’ll be able to pay your mortgage too.

Mortgage Insurance Premiums (MIPs)

Remember, the FHA collects mortgage insurance in case you default on your loans. That makes it different than homeowners insurance because it protects the lender—not you. FHA loans require you to pay an up-front MIP that’s 1.75% of your total FHA loan. Using our example from earlier, here’s how that looks:

$193,000 loan x 1.75% up-front MIP = $3,377

You’ll also pay an annual MIP as part of your monthly mortgage payment that costs anywhere from 0.45–1.05% of your average annual loan balance (the amount you owe every year). If you have a mid-range MIP, here’s how much you could have to pay:

$190,000 average annual loan balance x 0.8% annual MIP = $1,520 per year (or almost $127 a month extra on your mortgage payment)

The sort-of-good news: If your down payment is 10% or more, you only have to pay MIP for 11 years.

FHA Appraisal

You’re not the only one who has to qualify for an FHA loan: Your home does too. Your lender will require an FHA appraisal to make sure the home you want to buy is up to snuff. And that’s in addition to your regular home inspection.

FHA Loan Limits for 2022

The FHA limits how much money you can borrow based on local costs of living and housing market changes. Every year, the FHA studies the sale prices of homes in each U.S. county to find the median home price in that county.

Each county’s maximum loan limit is 115% of the median home price for the previous year.4 Want to learn more? Visit the HUD website to find out your county’s FHA limit.

Types of FHA Loans

When you’re considering an FHA loan, you may hear of:

203(k) FHA Loans

With a 203(k) loan, you borrow the cash to buy a house, plus some extra money to renovate it. Just keep in mind, there are extra restrictions with this type of loan. For instance, you may have to finish the renovations within a certain time frame, and you may need a second FHA appraisal after the work is done.

Home Equity Conversion Mortgages (HECMs)

HECMs are reverse mortgages that are backed by the FHA and target seniors who have equity. Equity is the part of your home that’s been paid for or increased in value. If your home’s worth $300,000 and you owe $100,000 on it, you have $200,000 in equity.

An HECM lets senior citizens borrow some of that equity to pay for renovations, retirement living expenses and so on. If they can’t pay it back, the FHA pays off the loan, takes ownership of the house, and kicks Grandma and Grandpa out. (See why we hate HECMs?)

Energy Efficient FHA Loans

This type of loan helps home buyers purchase energy-efficient homes or borrow extra money to upgrade their house with “green” features. (So it’s sort of like an eco-friendly 203(k) loan.)

245(a) Loans (aka Graduated Payment Mortgages)

Some home buyers—especially first-time home buyers who are just starting out in their careers—can’t afford a big house payment right away. But they expect their income to increase. A 245(a) loan lets home buyers start with small payments and gradually increases those payments over time.

Again, that can sound like a great deal . . . as long as your career goes exactly how you expected. But if you get laid off or passed over for that promotion? Bam! You’re stuck with a bigger house payment and the same—or less—income.

Refinances

Like a conventional mortgage, you can refinance an FHA loan to get a shorter loan term, secure a lower interest rate, or even borrow cash against your home’s equity. (That last one is called a cash-out refinance, and it sucks.)

Refinancing is really helpful if you can get a better deal or pay off your mortgage faster. But just because you can refinance doesn’t mean it’s always the smartest move. Learn when you should (and shouldn’t) refinance.

Pros and Cons of FHA Loans

An FHA loan might sound attractive if you’re having trouble saving a down payment or qualifying for a conventional mortgage, but it’s not all a bed of roses. Let’s look at the pros and the cons of FHA loans.

Pros

Low credit score requirements. You can qualify for an FHA loan with a credit score as low as 500. That sounds like a game changer, but the truth is you don’t even need a credit score to buy a house in the first place thanks to a process called manual underwriting. So this “pro” really isn’t that big of a deal.

Low down payments. You can get an FHA loan with as little as 3.5% down. Sometimes the FHA will even let a charitable organization or bank make your down payment for you—with some restrictions. So it can help you get into a house faster than saving for a down payment. (The bad news: You’re way more likely to end up with a house you can’t afford . . . and to lose it if anything changes with your finances.)

Potential for covered closing costs. The FHA lets home sellers, real estate agents, builders or developers cover your closing costs—up to 6% of the sales price. But look out! They might make this offer to convince you to buy a money pit.

Cash for home repairs and updates. If you’re planning to buy a home that needs work, a 203(k) can sound like a great idea. Just remember, that money isn’t free. You’ll have to pay it back as part of your loan.

Assistance to avoid foreclosure. If you struggle to make payments, the FHA might offer you forbearance, meaning they may reduce or even stop your mortgage payments—if you qualify.5 Of course, that can be a pretty big if, so don’t count on this assistance.

Potential for lower interest rates. Since the FHA guarantees these loans, lenders know they’ll get paid either way. So they’re usually more willing to give you a lower interest rate on an FHA loan than a conventional loan.

Now, let’s look at the other side of the fence. Here are some things that suck the life right out of FHA loans.

Cons

Up-front and annual MIPs. Simply put, MIPs add to the cost of your loan. And you’re paying thousands of dollars to benefit the lender, not you.

Bigger base loans. When you make a small down payment, you end up with a big honkin’ base loan. And since you owe more, it’ll either take longer to pay off your loan or you’ll have a bigger monthly mortgage payment. You’ll also end up paying more interest over the life of the loan—even if you do get a low interest rate to start with.

Relying on the government. Look, with an FHA loan, the government is there to help lower the lender’s risk—not yours. The government is not the hero in this story, and they are not swooping in to save you from a life of renting. You are the hero in your story, and you can save for a home the right way. Besides, the government has already proven that they’re bad with money (take a look at the national debt if you don’t believe us), so why on earth would you want to take their advice on how you should handle your debt?

Higher costs in the long term. FHA loans are made to get you into a house for as little money up front as possible. But you’ve got to consider the long-term costs. In the end, the extra MIPs and the larger amount in total interest you pay make FHA loans way more expensive than conventional loans. (More on that in a minute.)

No financial wiggle room. Becoming a homeowner is the American Dream, and FHA loans are just making it come true, right? But here’s the brutal truth: If you’re really that strapped for cash, you’re not ready to buy a home. Imagine what will happen when emergencies actually come up. (And trust us, emergencies always come up!) Buying a house you can’t afford isn’t a dream, it’s a nightmare.

So when should you buy a house? You can afford to buy a house when you’re debt-free, you can put 10–20% down, and your monthly mortgage payment is 25% or less of your take-home pay on a 15-year fixed-rate conventional mortgage. That way, you’ll have plenty of money left to save for the future and cover emergencies. You’ve got to give yourself some financial wiggle room—even if that means waiting until you’re ready for a conventional loan.

FHA vs. Conventional Loans

There’s a big difference in the cost of FHA and conventional loans, and we’ll get to that in a minute. (Spoiler alert: FHA loans actually cost more in the long run!) But first, let’s compare the basic differences between these two types of loans:

*You can get a conventional loan without a credit score, thanks to a process called manual underwriting.

**Percentages refer to the percent of the average annual loan balance.

FHA vs. Conventional Loans

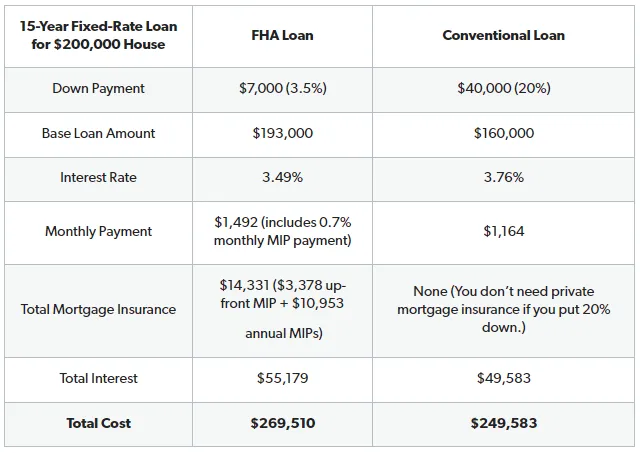

Nope! We don’t recommend FHA loans because they’re one of the most expensive types of mortgages. And they’re sneaky about it too: They seem cheaper up front, but when you look at the total cost, they’re actually more expensive.

Want to see for yourself? Check out the chart below. We used our mortgage calculator to compare a 15-year fixed-rate conventional loan and an FHA loan for a house priced at $200,000. To keep things simple, we left out property tax, homeowners insurance and HOA dues.

So a conventional loan could save you nearly $20,000! And those savings only go up if you buy a more expensive home.

We know it’s tough to think about strapping in and saving for a larger down payment if you don’t make much money or you don’t qualify for a 15-year fixed-rate conventional mortgage yet. But hang in there! You can save for a home.

FHA vs. Conventional Loans

The two biggest costs of buying a home are the down payment at the beginning and then your monthly mortgage payments for the next 15 years. The good news is, it is possible to save for a down payment of 10–20%. And you can save tens of thousands of dollars on your mortgage if you just make a few small changes to your budget.

Get a Smart Mortgage

Okay, we hope by now you realize that FHA loans stink like a wet dog on a hot day. They’re just not a smart money choice. So, what is a smart choice?

Getting a conventional loan from a lender who puts people ahead of profits. Make the smart choice and work with our RamseyTrusted friends at Churchill Mortgage. They’ll help you find a mortgage you can actually afford and pay off fast—so you can free up that money for more important things.